2023 - The impact of the global recession on startups

31/07/23 17:23

As we enter 2023 it is clear that the 'tech reset', in other words the current dot com bust, driven by the consequences of a post Covid recession and the Ukraine/Russian war, is having an adverse impact on all aspects of founding and running a startup.

The days of cheap money are long gone, and a more realistic approach (the new reality) is being taken by Venture Capitalists to valuations and viabilities of current and potential investments. The sums of money being invested at Seed, Series A and Series B are in many cases declining to level seen 5 or more years ago, whilst those more mature companies who are at later funding stages are being faced with reduced valuations and in some cases, down rounds.

According to Crunchable, Seed Stage investments in 2022 were 37% down year on year, whilst Series A and B had declined 59%.

There are a few VCs who have written down the value of some of their portfolio investments by over 50%!

The overall levels of investments made across most sectors are declining quarter on quarter and are likely to continue at least early into 2023. The more pessimistic are predicting continued declines well into 2024 before any sort of change is seen.

Those VCs with funds that are not fully invested are keeping their powder dry, whilst analysts are trying to determine who has reserves and to what degree and then, whether they will invest in the short term or hold out to see what happens.

Founders are already coming under pressure to look at their operational metrics and determine whether they are fundamentally sound and can deliver a sustainable business over the next 5 - 10 years.

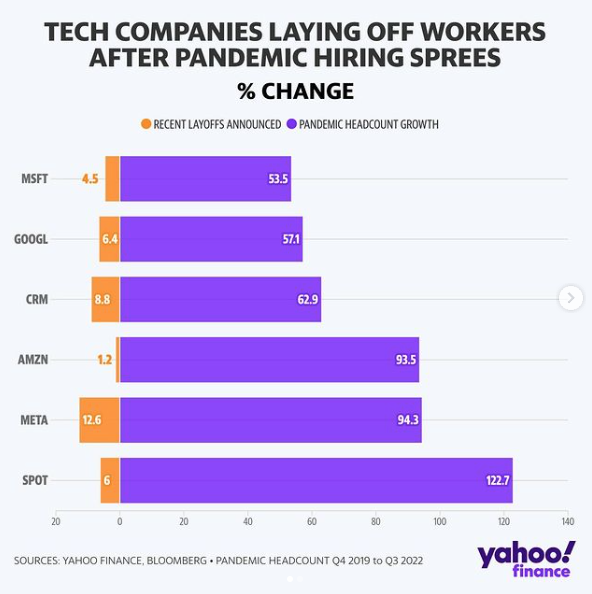

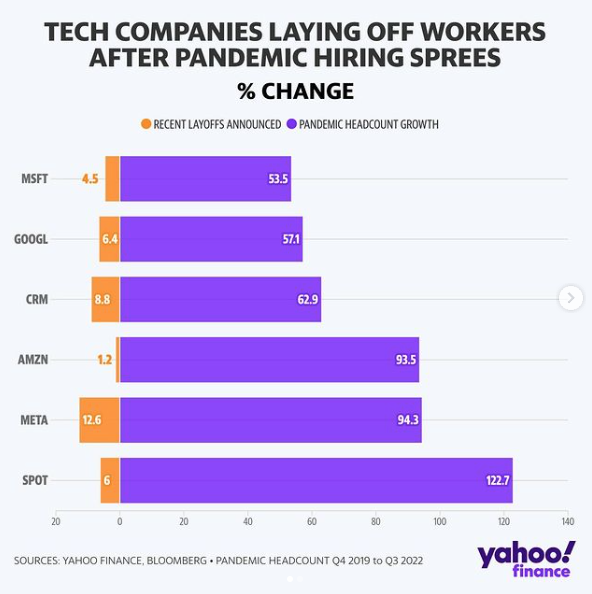

One of the consequences of this operational review is the downsizing in workforce numbers. This is not limited t just tech, although the larger numbers involved tend to be in this sector. Layoffs started to gather pace in late Q3 2022 and continue to this day, with some organisations outlining there is more headcount reduction to come. US tech layoffs are estimated to have exceeded 90,000 in 2022 whilst in the first week on 2023, large companies including Amazon and Salesforce have announced layoffs totalling 16,000 according to Crunchbase. As we continue in February layoff announcements continue.

During January 2023 Microsoft announced 10,000 staff layoffs shortly followed by Alphabet who announced 12,000 staff would be let go! The photo below gives an indication of the scale of the layoffs.

Placing such a large number of qualified tech skills into the jobs market in a short pace of time has a number of impacts. Employers who are hiring have a much bigger talent pool than before to recruit from, shifting the dynamics back in, or towards their favour.

The more entrepreneurial staff who have been laid off are using the event as a stimulus to do something different or, to start up their own business, so in 2023 I expect we will see some very smart people create some very interesting startups.

Those who have yet to raise finance are under no illusions that investors are taking more realistic, and some say, hard line, view of pre and post money valuations and future earnings prospects.

In the current adverse economic climate, likely to last for at least a few years, the risk profile has increased so investors will wish to reflect that fact in their investment decisions and dilution discussions.

In addition, investors are undertaking increased due diligence and seeking more detailed and regular reporting from those in whom they invest.

2023 is starting out as a bumpy one and it may get worse before it begins to improve!

The days of cheap money are long gone, and a more realistic approach (the new reality) is being taken by Venture Capitalists to valuations and viabilities of current and potential investments. The sums of money being invested at Seed, Series A and Series B are in many cases declining to level seen 5 or more years ago, whilst those more mature companies who are at later funding stages are being faced with reduced valuations and in some cases, down rounds.

According to Crunchable, Seed Stage investments in 2022 were 37% down year on year, whilst Series A and B had declined 59%.

There are a few VCs who have written down the value of some of their portfolio investments by over 50%!

The overall levels of investments made across most sectors are declining quarter on quarter and are likely to continue at least early into 2023. The more pessimistic are predicting continued declines well into 2024 before any sort of change is seen.

Those VCs with funds that are not fully invested are keeping their powder dry, whilst analysts are trying to determine who has reserves and to what degree and then, whether they will invest in the short term or hold out to see what happens.

Founders are already coming under pressure to look at their operational metrics and determine whether they are fundamentally sound and can deliver a sustainable business over the next 5 - 10 years.

One of the consequences of this operational review is the downsizing in workforce numbers. This is not limited t just tech, although the larger numbers involved tend to be in this sector. Layoffs started to gather pace in late Q3 2022 and continue to this day, with some organisations outlining there is more headcount reduction to come. US tech layoffs are estimated to have exceeded 90,000 in 2022 whilst in the first week on 2023, large companies including Amazon and Salesforce have announced layoffs totalling 16,000 according to Crunchbase. As we continue in February layoff announcements continue.

During January 2023 Microsoft announced 10,000 staff layoffs shortly followed by Alphabet who announced 12,000 staff would be let go! The photo below gives an indication of the scale of the layoffs.

Placing such a large number of qualified tech skills into the jobs market in a short pace of time has a number of impacts. Employers who are hiring have a much bigger talent pool than before to recruit from, shifting the dynamics back in, or towards their favour.

The more entrepreneurial staff who have been laid off are using the event as a stimulus to do something different or, to start up their own business, so in 2023 I expect we will see some very smart people create some very interesting startups.

Those who have yet to raise finance are under no illusions that investors are taking more realistic, and some say, hard line, view of pre and post money valuations and future earnings prospects.

In the current adverse economic climate, likely to last for at least a few years, the risk profile has increased so investors will wish to reflect that fact in their investment decisions and dilution discussions.

In addition, investors are undertaking increased due diligence and seeking more detailed and regular reporting from those in whom they invest.

2023 is starting out as a bumpy one and it may get worse before it begins to improve!